Category: Budgeting

-

New Credit Card Rules in 2025: What Higher Late Fees and Swipe Fee Changes Mean for You

In 2025, the credit card landscape is shifting again — and not necessarily in consumers’ favor. Two major regulatory developments are grabbing national attention: the rollback of the $8 late fee cap and renewed debates around swipe fees, which affect both credit card users and small businesses. Here’s what’s changing, what it means for your…

-

EV vs. Hybrid: Which One Saves You More Money in the Long Run?

As gas prices fluctuate and environmental concerns grow, more Americans are considering fuel-efficient vehicles — especially electric vehicles (EVs) and hybrids. But when it comes to finances, which is the better investment? Let’s break down the costs, tax incentives, maintenance, fuel savings, and long-term value to help you make the smartest financial decision. Initial Cost:…

-

How Much Do Tariffs Actually Affect Your Wallet — and What Can You Do to Protect Your Finances if Costs Go Up?

In 2025, tariffs are back in focus — especially as the U.S. considers or imposes new import taxes on goods from countries like China, Mexico, and others. These policies may seem like big-picture trade decisions, but the effects show up in everyday life — at the grocery store, the auto shop, or when you’re shopping…

-

How Interest Rate Cuts Could Affect Your Credit Cards, Loans, and Savings in 2025

With inflation cooling and the economy stabilizing, the Federal Reserve is signaling potential interest rate cuts in 2025. If you’ve got credit card debt, loans, or even a savings account — this shift could directly affect your wallet. But what does a rate cut really mean for your money? Let’s break it down. What Is…

-

How to Build an Emergency Fund — Even If You’re Living Paycheck to Paycheck

If you’ve ever had a medical bill hit your account out of nowhere… or your car suddenly broke down before payday… you already know why an emergency fund matters. But when you’re living paycheck to paycheck, the idea of setting aside money can feel impossible. The good news? You don’t need thousands overnight. You just…

-

How Online Mortgage Companies Like Rocket Mortgage, Better.com, and LoanDepot Work

Gone are the days when you had to sit across from a loan officer at your local bank to get a mortgage. Today, companies like Rocket Mortgage, Better.com, LoanDepot, and SoFi are changing how people apply for home loans — by putting the entire process online. If you’re a first-time homebuyer or thinking about refinancing,…

-

What Lenders Are Looking For: 5 Things You Need Before Applying for a Loan

Whether you’re applying for a mortgage, auto loan, personal loan, or even a credit card — one thing is certain: lenders want to know if they can trust you to pay them back. That trust is built on a handful of key factors. The better you understand what lenders are looking for, the more you…

-

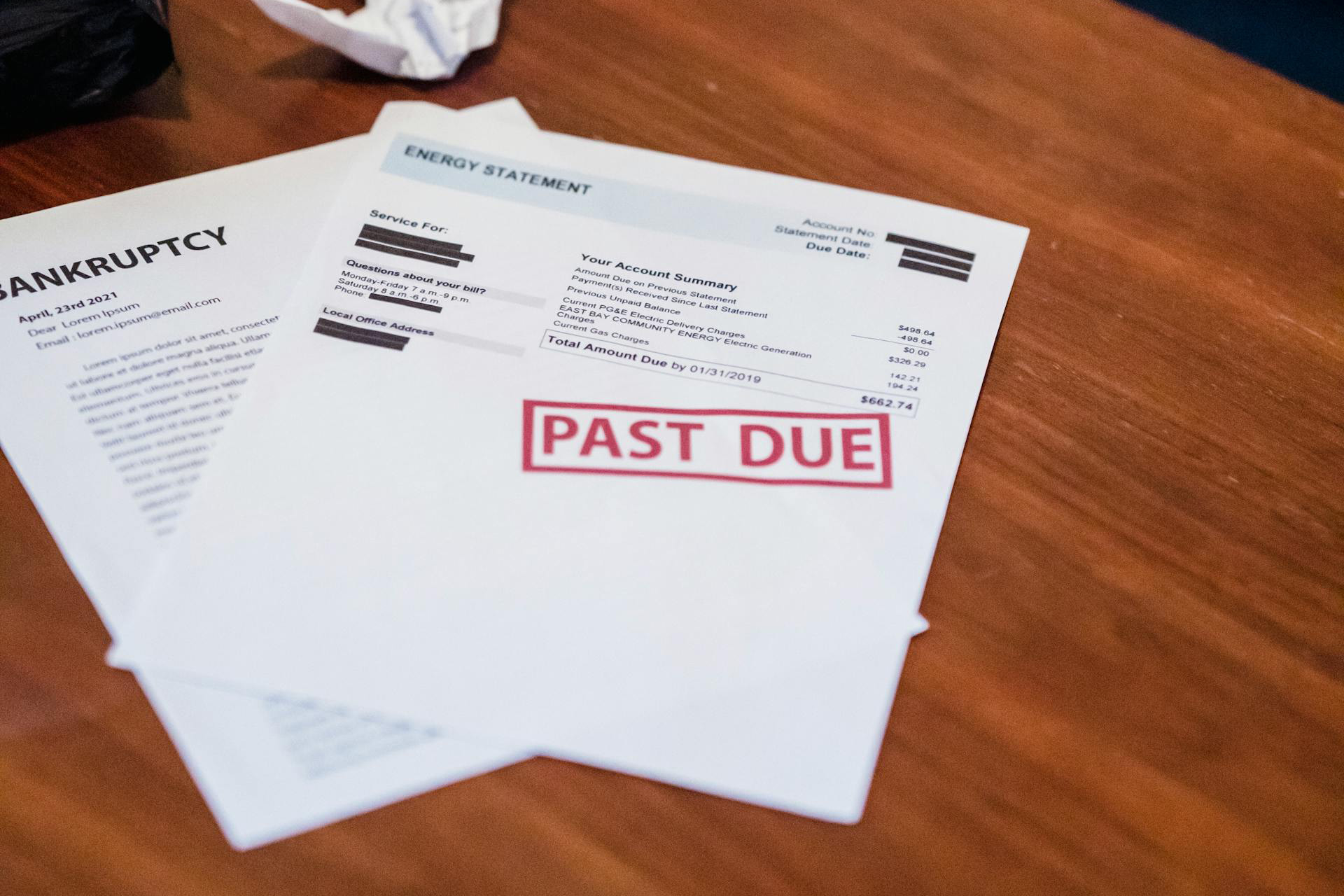

What to Do If You Have Bad Credit: A Step-by-Step Plan to Turn Things Around

Having bad credit can feel like hitting a financial wall. Denied for loans. Rejected for credit cards. Higher interest rates on everything. But here’s the truth: bad credit is not the end — it’s a starting point. You can rebuild. It won’t happen overnight, but with the right plan and consistent effort, you’ll see your…

-

Budgeting 101: How to Take Control of Your Money (Even If You’ve Never Budgeted Before)

Budgeting isn’t about being strict or never spending — it’s about knowing where your money goes, so you’re in charge of your finances instead of the other way around. Whether you’re living paycheck to paycheck or just want to build better habits, this guide will help you understand how to start a budget that works…