Category: Personal Finance

-

Unauthorized Charges on Your Credit Card? Here’s Exactly What to Do

Spotting a strange charge on your credit card statement can be alarming — and unfortunately, credit card fraud is more common than ever. Whether it’s a $500 charge you don’t recognize or a $2 subscription you never signed up for, don’t ignore it. Acting quickly not only helps protect your money, but it also minimizes…

-

Best Credit Monitoring Services That Help Detect Fraudulent Activity (2025 Guide)

Keeping an eye on your credit isn’t just about knowing your score — it’s about protecting yourself from identity theft, unauthorized accounts, and fraudulent activity that can wreck your financial life. Whether you’re recovering from bad credit or just want to stay safe, these top credit monitoring services will alert you to suspicious activity and…

-

How Online Mortgage Companies Like Rocket Mortgage, Better.com, and LoanDepot Work

Gone are the days when you had to sit across from a loan officer at your local bank to get a mortgage. Today, companies like Rocket Mortgage, Better.com, LoanDepot, and SoFi are changing how people apply for home loans — by putting the entire process online. If you’re a first-time homebuyer or thinking about refinancing,…

-

What Lenders Are Looking For: 5 Things You Need Before Applying for a Loan

Whether you’re applying for a mortgage, auto loan, personal loan, or even a credit card — one thing is certain: lenders want to know if they can trust you to pay them back. That trust is built on a handful of key factors. The better you understand what lenders are looking for, the more you…

-

What to Do If You Have Bad Credit: A Step-by-Step Plan to Turn Things Around

Having bad credit can feel like hitting a financial wall. Denied for loans. Rejected for credit cards. Higher interest rates on everything. But here’s the truth: bad credit is not the end — it’s a starting point. You can rebuild. It won’t happen overnight, but with the right plan and consistent effort, you’ll see your…

-

Bad Credit vs. No Credit: What’s the Difference and Why It Matters

If you’ve been denied for a credit card or loan, lenders may have told you that your credit is “too low” — or worse, that you have “no credit history.” While both situations can make borrowing difficult, they’re not the same — and how you rebuild or start fresh depends on which one you’re dealing…

-

Home Loans & Mortgages 101: What First-Time Buyers Need to Know

Buying your first home is a major life milestone — and one of the biggest financial decisions you’ll ever make. But navigating the mortgage process can feel overwhelming if you don’t know the basics. In this guide, we’ll break down how home loans work, what types of mortgages are available, and how to prepare for…

-

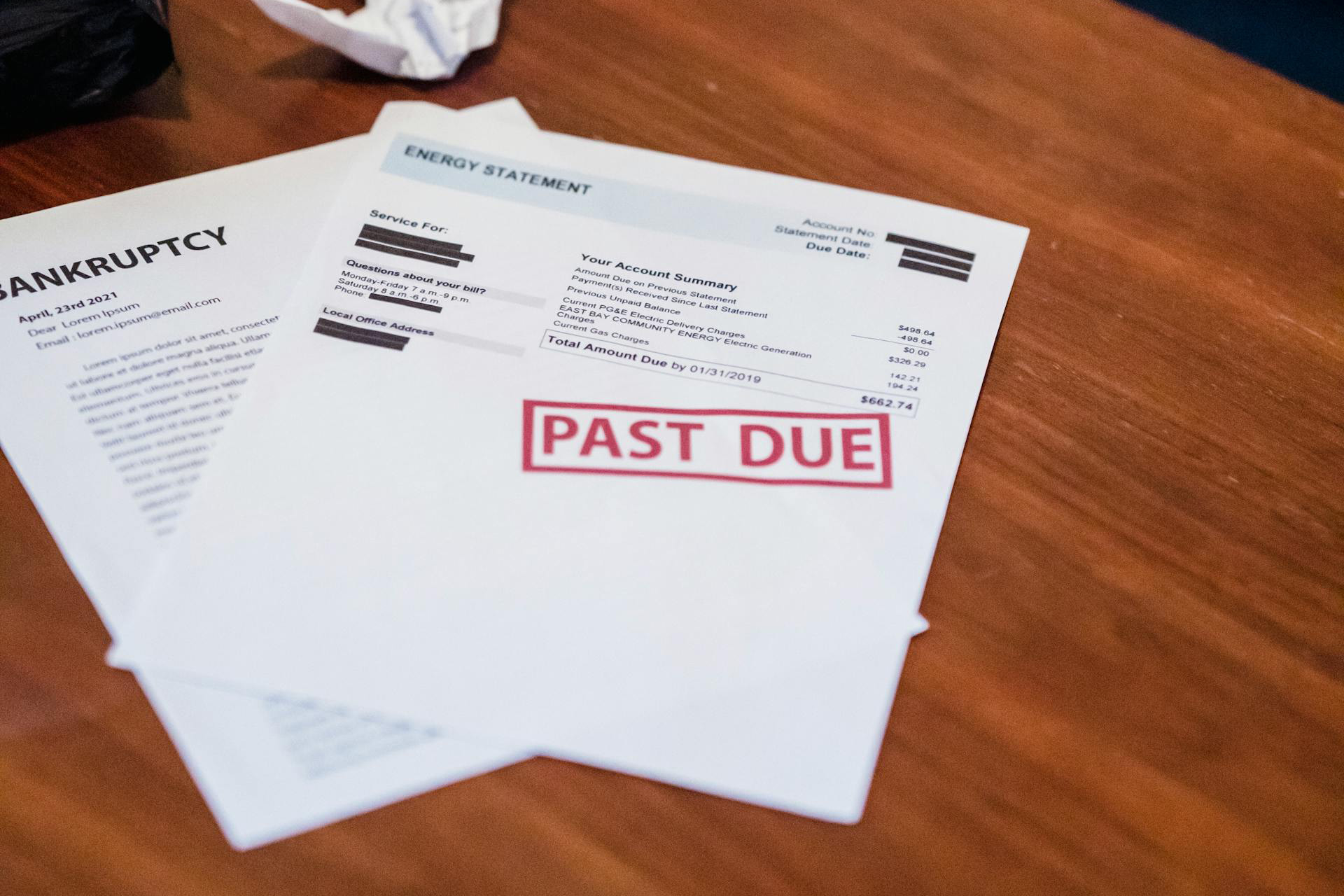

How to Manage and Pay Off Debt Without Losing Your Mind

Debt can feel like a heavy weight that never goes away. Whether it’s credit cards, student loans, personal loans, or medical bills, debt doesn’t just affect your bank account — it impacts your stress, sleep, and overall life stability. The good news? You can take control. This guide breaks down how to manage your debt…

-

Saving vs. Investing: What’s the Difference and Why You Need Both

If you’re serious about financial freedom, it’s not enough to just make money — you have to save it and grow it. That’s where saving and investing come in. Many people treat these terms as interchangeable, but they serve two very different purposes. In this post, we’ll break down the key differences, when to do…

-

Budgeting 101: How to Take Control of Your Money (Even If You’ve Never Budgeted Before)

Budgeting isn’t about being strict or never spending — it’s about knowing where your money goes, so you’re in charge of your finances instead of the other way around. Whether you’re living paycheck to paycheck or just want to build better habits, this guide will help you understand how to start a budget that works…