-

Best Credit Monitoring Services That Help Detect Fraudulent Activity (2025 Guide)

Keeping an eye on your credit isn’t just about knowing your score — it’s about protecting yourself from identity theft, unauthorized accounts, and fraudulent activity that can wreck your financial life. Whether you’re recovering from bad credit or just want to stay safe, these top credit monitoring services will alert you to suspicious activity and…

-

How Online Mortgage Companies Like Rocket Mortgage, Better.com, and LoanDepot Work

Gone are the days when you had to sit across from a loan officer at your local bank to get a mortgage. Today, companies like Rocket Mortgage, Better.com, LoanDepot, and SoFi are changing how people apply for home loans — by putting the entire process online. If you’re a first-time homebuyer or thinking about refinancing,…

-

What Lenders Are Looking For: 5 Things You Need Before Applying for a Loan

Whether you’re applying for a mortgage, auto loan, personal loan, or even a credit card — one thing is certain: lenders want to know if they can trust you to pay them back. That trust is built on a handful of key factors. The better you understand what lenders are looking for, the more you…

-

Mortgages 101: Getting Started on the Path to Homeownership

Buying your first home is one of the most exciting — and financially significant — decisions you’ll ever make. But before you start browsing listings or hitting open houses, it’s important to understand how mortgages work and what you need to do to prepare. This guide breaks down the mortgage process for beginners so you…

-

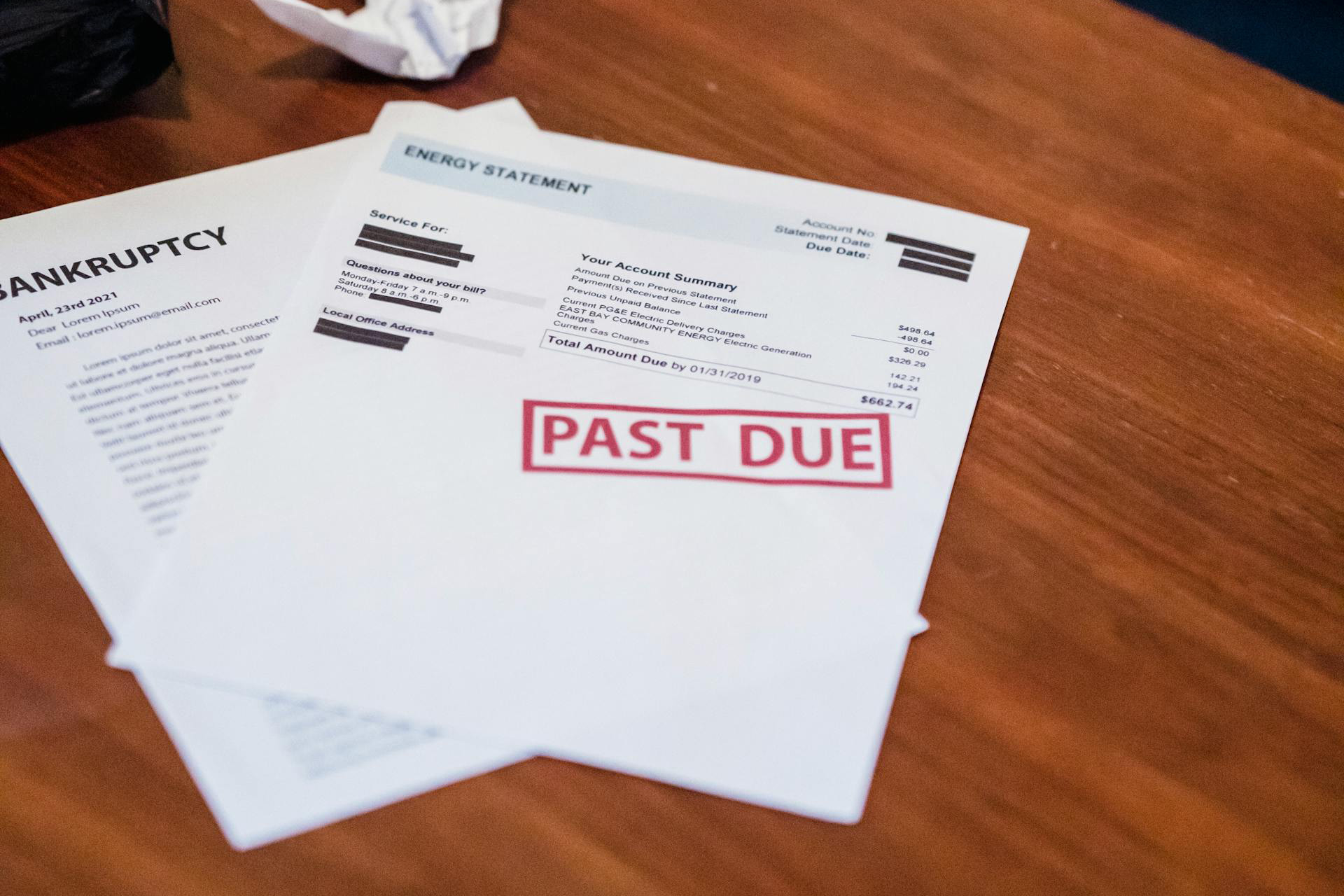

What to Do If You Have Bad Credit: A Step-by-Step Plan to Turn Things Around

Having bad credit can feel like hitting a financial wall. Denied for loans. Rejected for credit cards. Higher interest rates on everything. But here’s the truth: bad credit is not the end — it’s a starting point. You can rebuild. It won’t happen overnight, but with the right plan and consistent effort, you’ll see your…

-

Bad Credit vs. No Credit: What’s the Difference and Why It Matters

If you’ve been denied for a credit card or loan, lenders may have told you that your credit is “too low” — or worse, that you have “no credit history.” While both situations can make borrowing difficult, they’re not the same — and how you rebuild or start fresh depends on which one you’re dealing…

-

Home Loans & Mortgages 101: What First-Time Buyers Need to Know

Buying your first home is a major life milestone — and one of the biggest financial decisions you’ll ever make. But navigating the mortgage process can feel overwhelming if you don’t know the basics. In this guide, we’ll break down how home loans work, what types of mortgages are available, and how to prepare for…

-

Best Cars for Students in the U.S. (Affordable, Reliable & Great on Gas)

College students need cars that are affordable, reliable, safe, and good on gas — all without crushing their monthly budget. Whether you’re commuting to campus or balancing a part-time job, your car should help you get ahead, not leave you stuck with repairs or high payments. Here are some of the best cars for students…

-

Auto Loans 101: How to Finance a Car Without Getting Ripped Off

Buying a car is exciting — but the loan behind it? That’s where things can get confusing, fast. Whether it’s your first car or your next upgrade, knowing how auto loans work can save you thousands of dollars over time. This guide will help you understand the basics of auto financing, how to get the…

-

Student Loan Basics: What Every College Student Needs to Know Before Borrowing

Student loans can help make college possible — but they can also turn into a financial burden if you’re not careful. Before you sign anything, it’s important to understand how student loans work, what types are available, and how to borrow smart. This guide breaks down everything you need to know, in plain English, so…

-

Student Credit Tips: How to Start Building Credit in College (Without Going Into Debt)

College isn’t just about classes and degrees — it’s also the perfect time to start building your credit. And the earlier you start, the better off you’ll be after graduation. Good credit helps you rent an apartment, get approved for a car loan, qualify for better interest rates, and even land some jobs. The problem…

-

The Ultimate Student Budget Guide: How to Make Your Money Last in College

College is often the first time many students manage money on their own — and it’s easy to fall into the trap of overspending, especially with tuition, books, food, and social life pulling at your wallet. The good news? You don’t need a finance degree to budget smartly. Whether you’re living on campus, commuting, or…